If you are interested in investing in the stock market, the first step is to open a Demat account. A demat account is a digital account that holds stocks, bonds, and other securities electronically. It has made it easy for investors to buy and sell securities online without the need for physical certificates. Once you have opened a Demat account, you can start trading like a pro. In this blog post, we will guide you through the process of opening an online Demat account and share some tips to help you trade like a pro.

What is a demat account?

In India, a Demat account is mandatory for buying and selling stocks or other securities. A demat account or a dematerialized account is an electronic account that holds your shares, mutual funds or bonds in an electronic form. It is like a bank account. Just as you deposit money in a bank account, you can deposit stocks, bonds, and mutual funds in a Demat account. The account holder gets an account number and a statement of holdings.

How to open a Demat account?

To open a Demat account, you will need to submit some documents. They are:

– PAN card

– AADHAAR card

– Address proof (passport, driving license, voter ID or utility bills)

– A passport-size photograph

– Bank statement or a canceled cheque

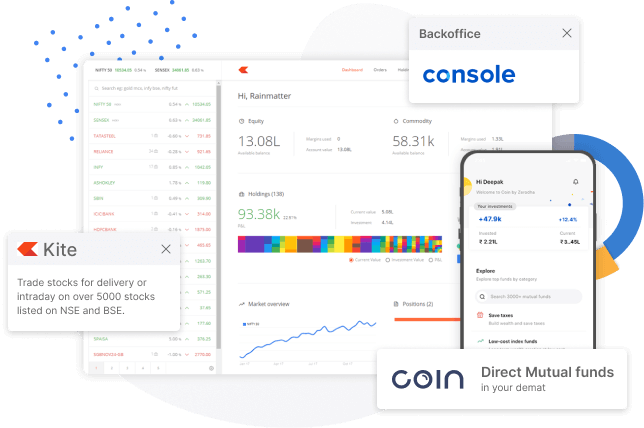

Choosing the right broker and platform for opening a Demat account.

There are several online brokers in India that offer Demat accounts. Before choosing a broker, you should consider the following factors:

– Broker reputation

– Brokerage charges

– Trading platform

– Customer support

– Research and analysis tools

Once you have chosen the broker, follow these steps to open a Demat account:

– Visit the broker’s website and go to the ‘Open an Account’ section.

– Fill in the application form with your personal and financial details.

– Upload the required documents.

– Sign the agreement and submit the form.

How to start trading stocks like a pro.

Here are some tips to trade like a pro:

– Do your research – Before investing in any company, research the company’s financials, management, industry trends, and competition.

– Have a long-term perspective – Long-term investments have better chances of giving higher returns than short-term trading.

– Keep an eye on the market – Keep yourself updated with market trends and world events that impact the stock market.

– Diversify your portfolio – Instead of putting all your money in one stock or sector, diversify your portfolio to minimize risks.

– Have a disciplined approach – Have a plan and stick to it. Do not let emotions drive your investment decisions.

Understanding the trading process and navigating the platform.

To trade like a pro, understanding the share trading process and navigating the platform is crucial. Here is a brief overview.

– Placing an order – There are two types of orders – market order and limit order. A market order is executed immediately at the prevailing market price whereas a limit order is executed at a specified price.

– Tracking your portfolio – Once you have bought stocks, you can track your portfolio and monitor their performance through the trading platform.

– Exit strategy – Have an exit strategy in place. It can be a predefined profit or loss amount, a trailing stop-loss or a technical chart indicator.

Conclusion.

Opening a Demat account and trading in stocks can seem daunting but with the right guidance, it can be an easy and profitable experience. We hope that this blog post has helped you understand the basics of opening a Demat account and trading like a pro. Remember to have a long-term perspective, do your research, diversify your portfolio and have a disciplined approach. Happy investing!